Our Perspective

Our listen first, then educate approach helps clients understand how proper life insurance and estate planning not only helps protect, preserve, and grow all they’ve worked a lifetime to build, but also serves their long-term purpose and family values. This helps create enduring wealth.

You (and your clients) Deserve a Better Life Insurance Experience

We can help.

At TDC, we firmly believe that you don’t buy life insurance just to buy life insurance. It should serve a purpose, and contribute to your client’s financial plan. We believe that, by combining this purpose with best-in-class strategies and products, we can deliver a unique insurance experience for you and your clients.

What Sets TDC Life Apart From the Others

LEAD WITH SERVICE

LET OUR KNOW-HOW DO THE TALKING

BRING VALUE TO EVERY SITUATION AND INTERACTION

Not Too Big. Not Too Small. Just Right.

We believe service should be at the cornerstone for any trusted relationship. We dedicate our time, energy, resources, and advice to better our partners and their relationship with their clients. Through this commitment, we believe we are the perfect fit to tackle the wealth preservation needs of your clients.

Too Small: Small Agency

A smaller agency simply doesn’t have the dedicated resources to properly plan and manage your client’s wealth perseveration and transfer strategies. They also will not have the volume of business necessary to formulate dedicated relationships with insurance carriers which can help with rating and premium advocacy.

- Motivated by Survival

- Market Indifference

- Limited Resources

- Lacks Sophistication

- Not Sustainable

Too Big: Large Agency

You’ve heard the term “just a number,” and when it comes to larger insurance agencies, this couldn’t be closer to the truth. In working with a larger agency, you sacrifice the boutique level of service your clients deserve as well as commitment to ongoing portfolio management to ensure all is performing as expected.

- Siloed

- Cookie Cutter Solutions

- Hierarchical

- Impersonal Relationships

- Motivated by Outside Shareholders

- Volume Drives Business

- Lacks Creativity

Just Right: TDC Life

TDC Life brings you the best of both worlds. Our experience in working alongside our advisor network for over 60 years gives you direct access to a myriad of insurance carriers and their products as well as the ongoing, dedicated service of our expert team.

- Bespoke Solutions

- Service Oriented

- Motivated by Clients

- Client Focused

- Market Leverage

- Independent

- Respect Across Industry

- Collaborative

- Quality Resources

- Est. 1958

A Step-By-Step Guide Of How We Help Accomplish Your Life Insurance Goals

Our innovative team and proven process means you benefit from a team who has seen it all, done it all, and there's no situation too complex for us to solve.

Explore

EXPLORE CASE DETAILSThe TDC team will explore all case details during this initial phase. We listen and seek to understand each client’s unique circumstances and long-term goals. This will inform the rest of our plan.

Compile

GATHER ALL NECESSARY INFORMATIONTDC will collect a series of personal information necessary to begin our analysis including, but not limited to medical records, policy details, financials, and estate planning documents.

Analyze

REVIEW AND STRATEGIZETDC will apply its expertise to formulate potential plan designs, submit an informal application, and negotiate offers directly with our comprehensive list of insurance carriers on behalf of the client.

Recommend

PRESENT PLAN DESIGNWith a firm understanding of your goals and an analysis of the insurance market, we present our plan design. Specific recommendations are made to the client, policy owner, and/or advisor.

Implement

EXECUTE PLAN DESIGNWe have a plan that aligns with family goals, and now it’s time to execute the plan. Our dedicated client service team will follow through on plan design and deliver the end policy to the client.

Live Life

ONGOING ANALYSISWe don’t just want to be your trusted advisor, but your trusted advisor for life. This means ongoing policy management – we monitor performance and continuously search for improved products and/or more efficient plan designs.

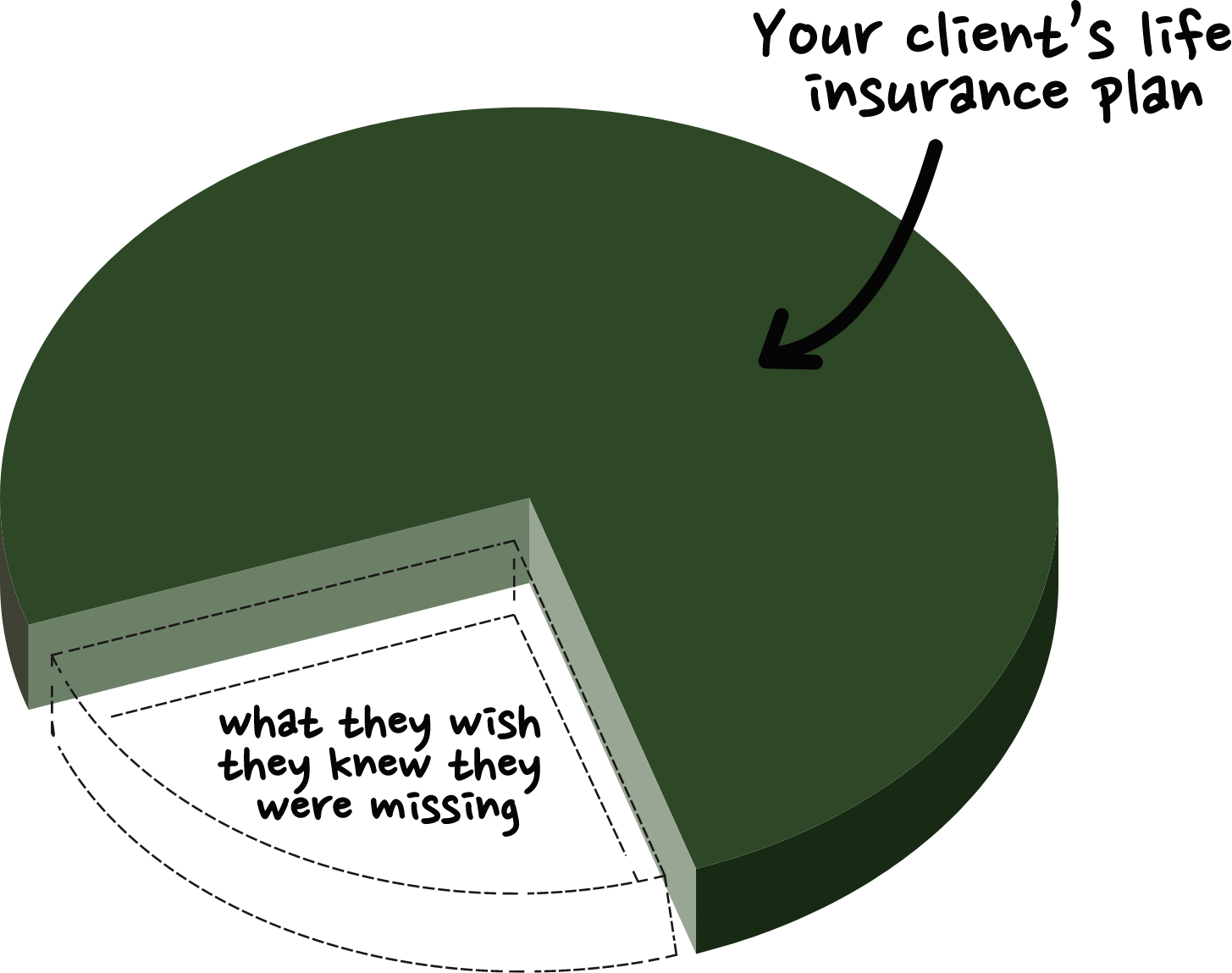

We Bring Value Because Life Insurance Is All We Do

We are on a mission to help our advisor partners by structuring life insurance plans and strategies that meet and exceed their client's expectations. Here are a few examples of how we enhance your client experience and help secure the best products, strategies, and long-term results for your clients.

Planning Goes A

Long Way

We firmly believe a goal without a plan is just a wish. We take our time to understand your situation, acquire the coverage that suits your family/business needs and goals, and continue to measure results to ensure your plan stays on track.

Better Underwriting.

Better Results.

This is a simple concept but tough for many to follow through on. Based on our relationships with best-in-class carriers, we aggressively advocate for each client and enhance value via a competitive auction to lower premiums and maximize results.

Independent Access to

All Products

To get the best results and ensure your client’s interests come first, your life insurance advisor needs access to the entire insurance market. As an independent broker, TDC Life has access to over … insurance carriers and their library of insurance products.

Measure and Test

with Facts and Math

Results are typically better when you measure them. We continually measure and test through policy market reviews and longevity analysis and frequently vet alternative solutions all in our never-ending commitment to optimize your client’s return.

Treat Insurance as a

Real Financial Instrument

We believe you don’t buy life insurance just to buy life insurance. It serves a particular and important role in a family’s overall financial plan, and should be treated as such. We work as your advisor to help ensure you have an expert at the table for this part of the financial plan.

We’re Here. Before,

During, and After.

We’ve been in business for over 60 years for a reason. We build trust with our advisors and their clients, and the life insurance planning we do is built to help your clients, their children, and their children. Helping create generational strategies is what we do.